Statistics previously maintained and reported by the IRS show that the research credit has broad application to U.S. businesses of all sizes and industries. Ranging between $7 and $12 billion over the past decade, the research credit is one of the largest corporate tax expenditures in the federal budget. Taxpayers of all sizes claim the research credit. Roughly one-fourth of all businesses that claim the research credit have assets of less than 1 million.

Research credit claimants are widely dispersed across industrial sectors, with the manufacturing industry and the professional, scientific, and technical services sector accounting for 68% of all claimants.

To be considered a Qualified Research Activity (QRE), your company's activities must meet the criteria defined in what is known as "the four-part test". The language in the tax code can make claiming the research tax credit sound much more complicated than it really is.

The two key elements of a research credit claim are uncertainty and experimentation. If your company faces uncertainty while developing or improving a product, process, formula, technique, software, or while inventing something, and are conducting some form of experimentation to resolve that uncertainty, you most likely have a research tax credit claim.

In simplest terms, if your business is conducting any of the following activities, you are most likely eligible to claim the research tax credit:

Developing or improving products

Developing or improving processes (e.g., manufacturing techniques, improved process design)

Prototyping

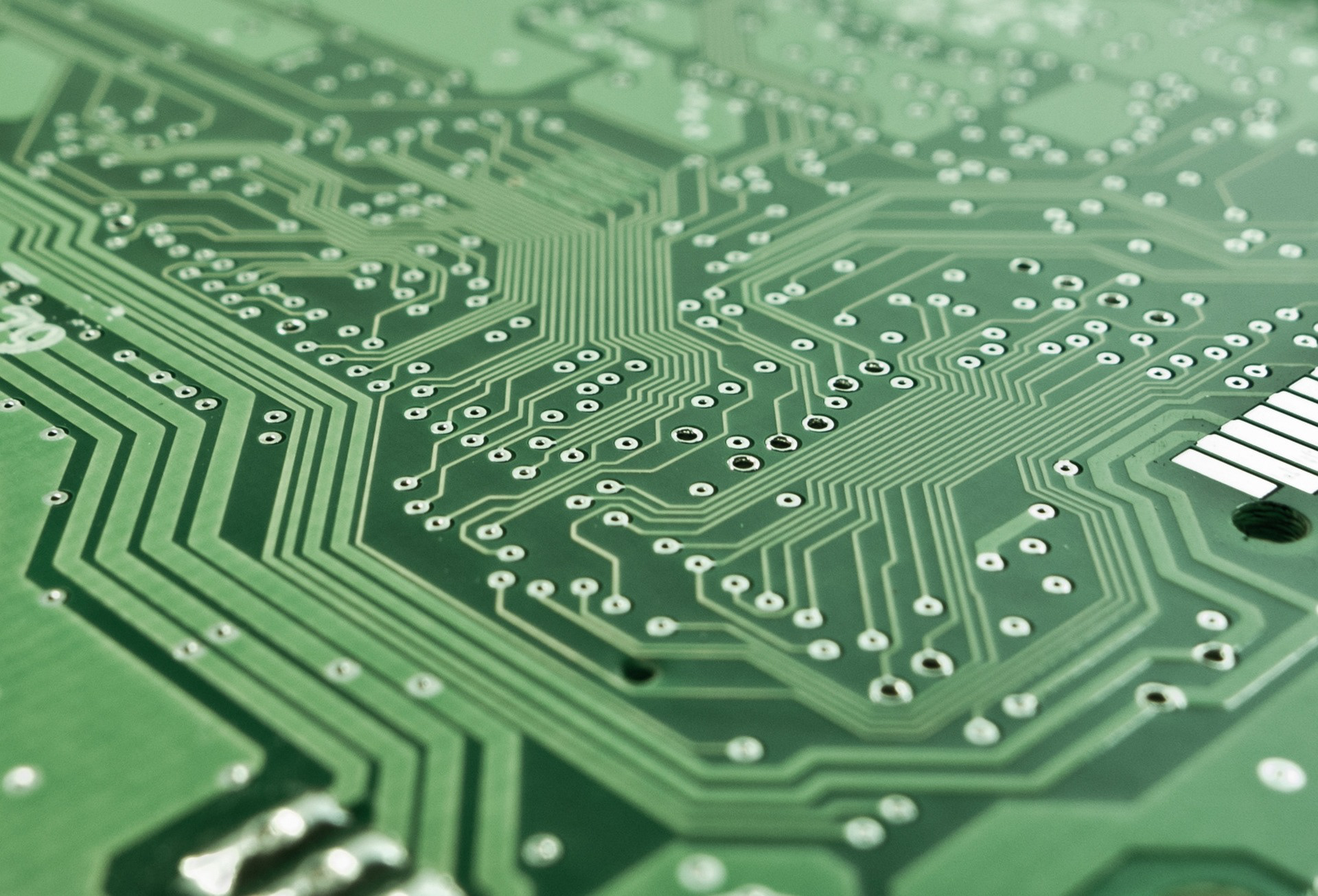

Software development

Improving existing technologies

Application of existing technologies in a new or improved manner

Designing and building self-constructed assets

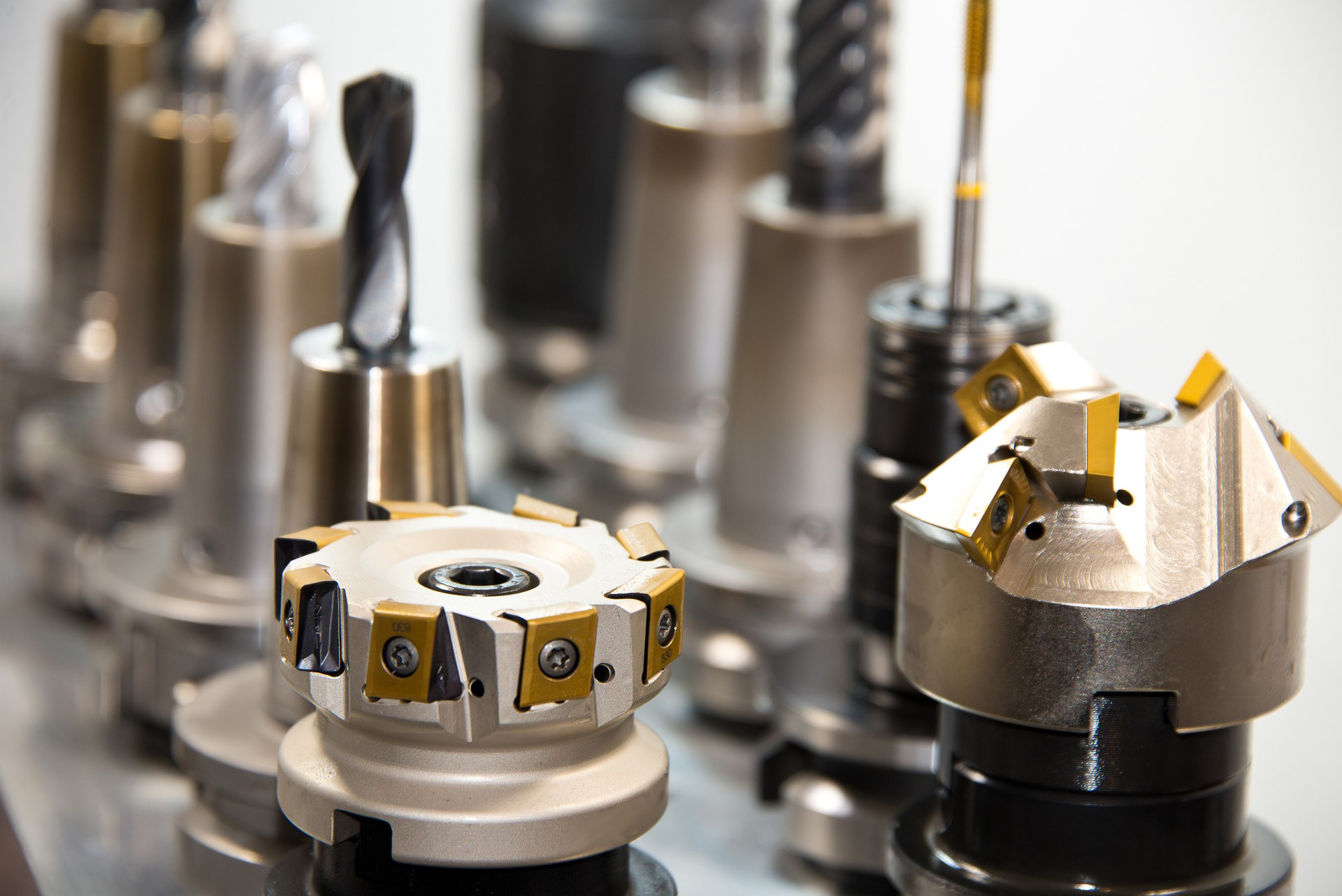

Tooling design and development

Engineering (in-house or subcontract)

Skilled trades (welding, fabrication, machining)

CAD & BIM Modeling

Prototyping

First article design and production runs

Life Sciences

Architecture & Civil Engineering

Manufacturing

Aerospace & Defense

Electronics

Energy Sector

Industrial Engineering & Design

Information Technology

Fabrication

Food Industry

Agriculture

WHAT IS THE FOUR PART TEST?

1. Technological in Nature - Activities must rely on the fundamentals of physical or biological science, engineering, or computer science.

2. Permitted Purpose - Activities must be performed in an attempt to improve the functionality, performance, reliability, or quality of a new or existing business component.

3. Eliminate Uncertainty - Activities intended to discover information that could eliminate technical uncertainty concerning the development or improvement of a product, process, formula, technique, invention, or software.

4. Process of Experimentation - All of the activities must include a process of experimentation including testing, modeling, simulations, systematic trial and error.